How to do a simple cash flow?

A basic way to calculate cash flow is to sum up figures for current assets and subtract from that total current liabilities. Once you have a cash flow figure, you can use it to calculate various ratios (e.g., operating cash flow/net sales) for a more in-depth cash flow analysis.

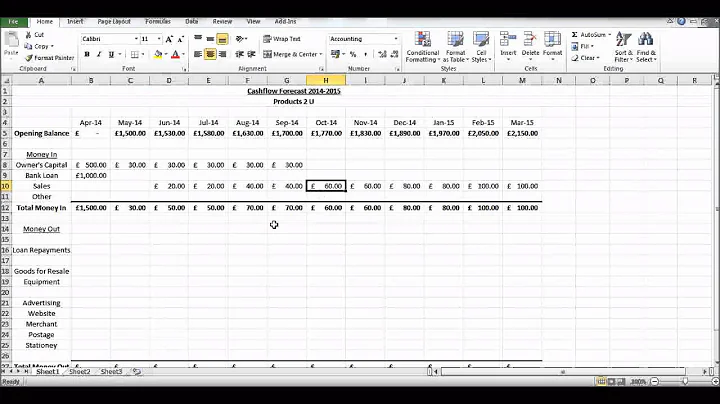

- Decide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months. ...

- List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in. ...

- List all your outgoings. ...

- Work out your running cash flow.

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure. Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital. Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash.

- Start with the Opening Balance. ...

- Calculate the Cash Coming in (Sources of Cash) ...

- Determine the Cash Going Out (Uses of Cash) ...

- Subtract Uses of Cash (Step 3) from your Cash Balance (sum of Steps 1 and 2)

Examples of operating cash flows include sales of goods and services, salary payments, rent payments, and income tax payments.

Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time, and can be used to measure rates of return, actual liquidity, real profits, and to evaluate the quality of investments.

Cash flow is the amount of cash and cash equivalents, such as securities, that a business generates or spends over a set time period. Cash on hand determines a company's runway—the more cash on hand and the lower the cash burn rate, the more room a business has to maneuver and, normally, the higher its valuation.

So, is cash flow the same as profit? No, there are stark differences between the two metrics. Cash flow is the money that flows in and out of your business throughout a given period, while profit is whatever remains from your revenue after costs are deducted.

The formula for calculating the cash-on-cash return involves taking the annual pre-tax cash flow and dividing it by the initial cash investment (i.e., the equity contribution).

Free cash flow = sales revenue - (operating costs + taxes) - required investments in operating capital. Free cash flow = net operating profit after taxes - net investment in operating capital.

How do you fill out a cash flow worksheet?

- Review the cash flows options for the engagement.

- Define the closing cash and cash equivalents.

- Determine the number of analysis items.

- Complete the analysis items.

- Balance the Cash Flow Worksheet.

- Operating cash flow.

- Investing cash flow.

- Financing cash flow.

The primary aim of the monthly cash flow report is to present an overview of the financial activity experienced throughout the month. Organizations rely on monthly cash flow statements to closely monitor cash inflows and outflows. Typical users of the cash flow report are CFOs, controllers, and accountants.

Positive cash flow indicates that a company's liquid assets are increasing. This enables it to settle debts, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges. Negative cash flow indicates that a company's liquid assets are decreasing.

A cash flow problem occurs when the amount of money flowing out of the company outweighs the cash coming in. This causes a lack of liquidity, which can inhibit your ability to make payments to suppliers, repay loans, pay your bills and run the business effectively.

Positive cash flow indicates that a company brings in more money than it is spending and has enough cash to continue operating. Negative cash flow is the opposite of this — when there is more cash outflow than inflow into the company.

Cash flow diagrams visually represent income and expenses over some time interval. The diagram consists of a horizontal line with markers at a series of time intervals. At appropriate times, expenses and costs are shown.

To convert your accrual net profit to cash, you must subtract an increase in accounts receivable. The increase represents income that has been recorded but not yet collected in cash. A decrease in accounts receivable has the opposite effect — the decrease represents cash collected, but not included in income.

Key Takeaways. Revenue is the money a company earns from the sale of its products and services. Cash flow is the net amount of cash being transferred into and out of a company.

There are a couple of reasons why cash flows are a better indicator of a company's financial health. Profit figures are easier to manipulate because they include non-cash line items such as depreciation ex- penses or goodwill write-offs.

What is a cash flow calculator?

Use this calculator to determine if the money coming into your business (i.e. revenue and income) is enough to cover your financial obligations (i.e. payroll and other expenses) for a set period.

An actionable cash flow statement in Excel. We can see that a cash flow statement displays cash inflows and outflows from operations, investments, and financing activities. The final items clearly show the amount of cash and cash equivalents that a company had at the beginning of the period and the end of it.

The cash flow statement helps an organisation to record the total inflows as well as outflows of cash during a particular accounting period. The income statement is used by an organisation to record all items related to revenues, expenses, gains and losses during a particular accounting period.

Key Takeaways: EBITDA stands for earnings before interest, taxes, depreciation, and amortization, and its margins reflect a firm's short-term operational efficiency. EBITDA is useful when comparing companies with different capital investment, debt, and tax profiles. Quarterly earnings press releases often cite EBITDA.

Cash Flow from Operating Activities

For most small businesses, Operating Activities will include most of your cash flow. That's because operating activities are what you do to get revenue. If you run a pizza shop, it's the cash you spend on ingredients and labor, and the cash you earn from selling pies.